Description

A Project Report On Taxation (Final Project Report)

| After purchase, For products with delivery between X to Y days only. | |

|---|---|

| Create a ticket | SUPPORT / TICKET |

Page Length : 56

EXECUTIVE SUMMARY

For any research assignment, a proper planning is required and the same holds true in case of present study. This project is titled as “Service tax & Excise Duty”. The reasons behind choosing this project is that I find there is very interesting topic because it is the biggest source of the finance for the government and also I have done my summer internship in the company which is related to the taxation that is Idemitsu Lube India Pvt. Ltd.

Service Tax:

Service means any activity carried out by a person for another person for consideration and includes a declared service. But

1) It must be activity.

2) It must be done by a person for another person.

3) There must be a consideration for provision of service.

4) Includes a declared service.

Excise Duty:

An excise duty is a type of tax charged on goods produced within the country (as opposed to customs duties, charged on goods from outside the country).

Source of revenue for government to provide public service,

- For the liability of duty of central excise to arise, the item in question should not only be goods it should also be excisable goods.

- Goods become excisable if and only if it is mentioned in the Central Excise Tariff Act 1985.

- Goods must be movable. Duty cannot be levied on immovable property .Central excise duty cannot imposed on plant and machinery.

- Goods must be marketable .The goods must be known in the market and must be capable of being bought or sold.

- The liability to pay tax excise duty is always on the manufacturer or producer of goods.

There are three types of parties who can be considered as manufacturers:

- Those who personally manufacture the goods in question

- Those who get the goods manufactured by employing hired labor.

- Those who get the goods manufactured by other parties.

Content

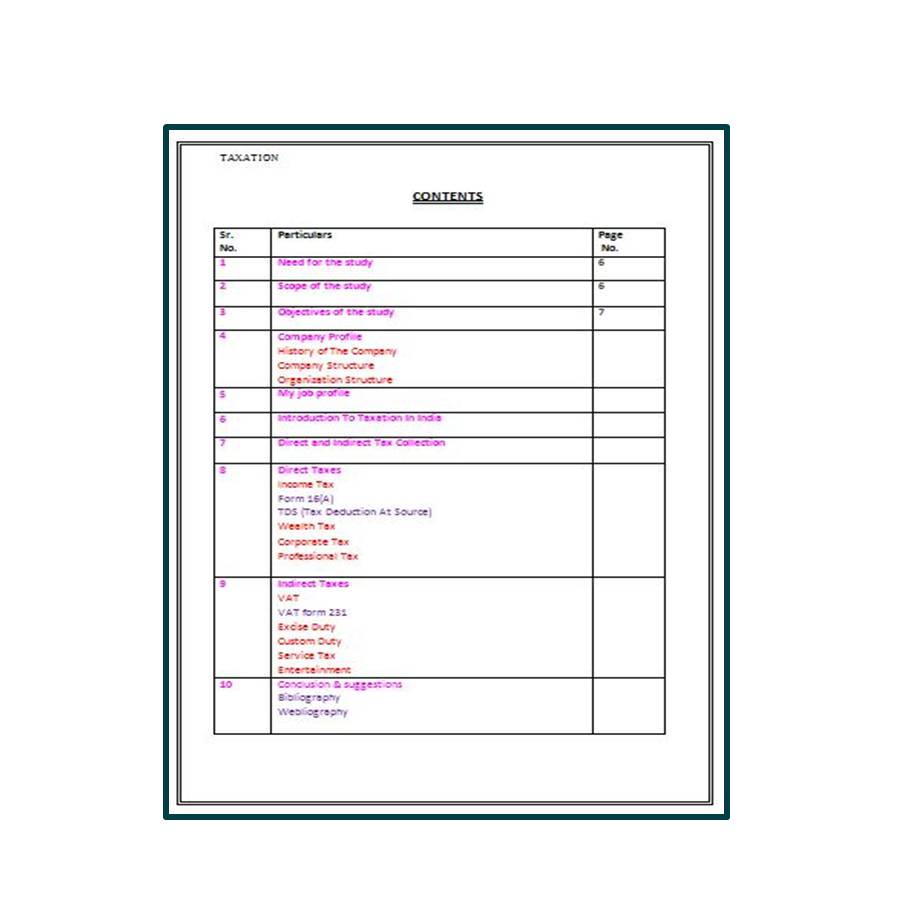

| Sr. No. | Particulars | Page No. |

| 1 | Need for the study | 6 |

| 2 | Scope of the study | 6 |

| 3 | Objectives of the study | 7 |

| 4 | Company Profile

· History of The Company · Company Structure · Organization Structure |

|

| 5 | My job profile | |

| 6 | Introduction To Taxation In India | |

| 7 | Direct and Indirect Tax Collection | |

| 8 | Direct Taxes

· Income Tax § Form 16(A) § TDS (Tax Deduction At Source) · Wealth Tax · Corporate Tax · Professional Tax |

|

| 9 | Indirect Taxes

· VAT § VAT form 231 · Excise Duty · Custom Duty · Service Tax · Entertainment |

|

| 10 | Conclusion & suggestions

§ Bibliography § Webliography |

| Services Offered |

| I only accept those projects that I can do 100% before the deadline.

Why you choose me? |

Reviews

There are no reviews yet