Description

Performance evaluation of selected commodities (Final Project Report)

| After purchase, For products with delivery between X to Y days only. | |

|---|---|

| Create a ticket | SUPPORT / TICKET |

Page Length : 73

Executive Summary

Commodity Market is an organized traders’ exchange in which standardized, graded products are bought and sold. Worldwide, there are 50 major commodity exchanges that trade over 100 commodities, ranging from wheat and cotton to silver and oil. Most trading is done in futures contracts, that is, agreements to deliver goods at a set time in the future for a price established at the time of the agreement.

Futures trading allow both hedging to protect against serious losses in a declining market and speculation for gain in a rising market. For example, a seller may sign a contract agreeing to deliver grain in two months at a set price. If the grain market declines at the end of two months, the seller will still get the higher price quoted in the futures contract. If the market rises, however, speculators buying grain stand to profit by paying the lower contract price for the grain and reselling it at the higher market price. Spot contracts, a less widely used form of trading, call for immediate delivery of a specified commodity and are often used to obtain the goods necessary to fulfill a futures contract. An independent U.S. regulatory agency, the Commodity Futures Trading Commission was established in 1974 to regulate commodity markets. In 1982, the Chicago Mercantile Exchange introduced a futures contract for Standard & Poor’s 500 U.S. companies that allow investors to speculate on the future prices of those stocks.

Trading of S&P 500 and other financial futures has broken down some of the barriers that once separated stock, bond, and commodity markets and made it easier for investors to hedge their stock investments. Critics charge that the futures trading at the commodity markets in Chicago have made stock prices more volatile.

The Chicago Board of Trade is the largest futures and options exchange in the United States, the largest in the world is Eurex, an electronic European exchange.

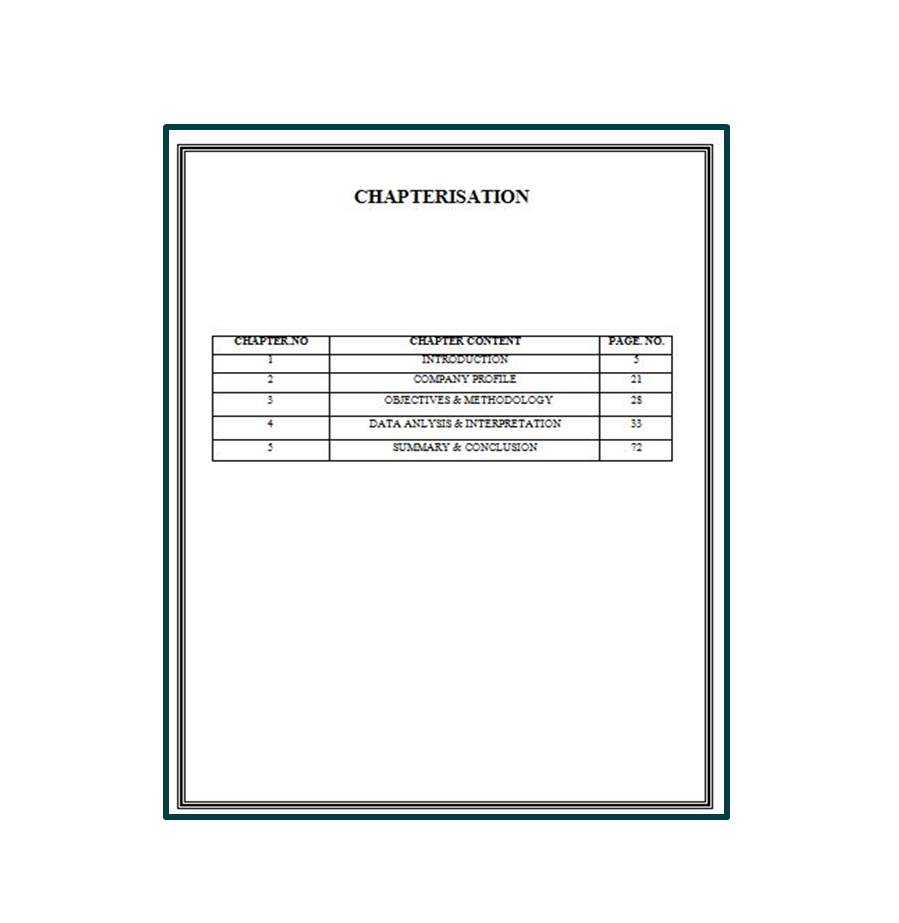

Content

| CHAPTER.NO | CHAPTER CONTENT | PAGE. NO. |

| 1 | INTRODUCTION | 5 |

| 2 | COMPANY PROFILE | 21 |

| 3 | OBJECTIVES & METHODOLOGY | 28 |

| 4 | DATA ANLYSIS & INTERPRETATION | 33 |

| 5 | SUMMARY & CONCLUSION | 72 |

| Services Offered |

| I only accept those projects that I can do 100% before the deadline.

Why you choose me? |

Reviews

There are no reviews yet