Description

Portfolio Management Services in Mutual Funds (Final Project Report)

| After purchase, For products with delivery between X to Y days only. | |

|---|---|

| Create a ticket | SUPPORT / TICKET |

Page Length : 75

Executive Summary

Investing money where the risk is less has always been risky to decide. The first factor, which an investor would like to see before investing, is risk factor. Diversification of risk gave birth to the phenomenon called Mutual Fund.

The Mutual Fund Industry is in the growing stage in India, which is evident from the flood of mutual funds offered by the Banks, Financial Institutes & Private Financial Companies.

As a part of my study curriculum it is necessary to conduct a grand project. It provides me an opportunity to understand the particular topic in depth and which leads to that topic.

My Project topic is Portfolio Management services in Mutual Funds which give special emphasis on creation of Portfolio’s, Portfolio revision and Comparison of Mutual Funds with various Performance measures.

In Portfolio Management it is very important to manage investor’s portfolio efficiently. By efficient we mean which reduces the risk of investor and increases return on the other hand.

This project is all about how to manage an Investor’s portfolio in mutual fund. How to diversify the investments into different schemes of funds

My First Phases covers mutual fund industry, current economic condition of the economy, brief introduction to portfolio Management services, investor’s behavior and types, their objective, risk appetite.

My Second Phase covers creation of Portfolio’s as per different type of Investor, Portfolio revision and Comparison of Mutual Funds with various Performance measures.

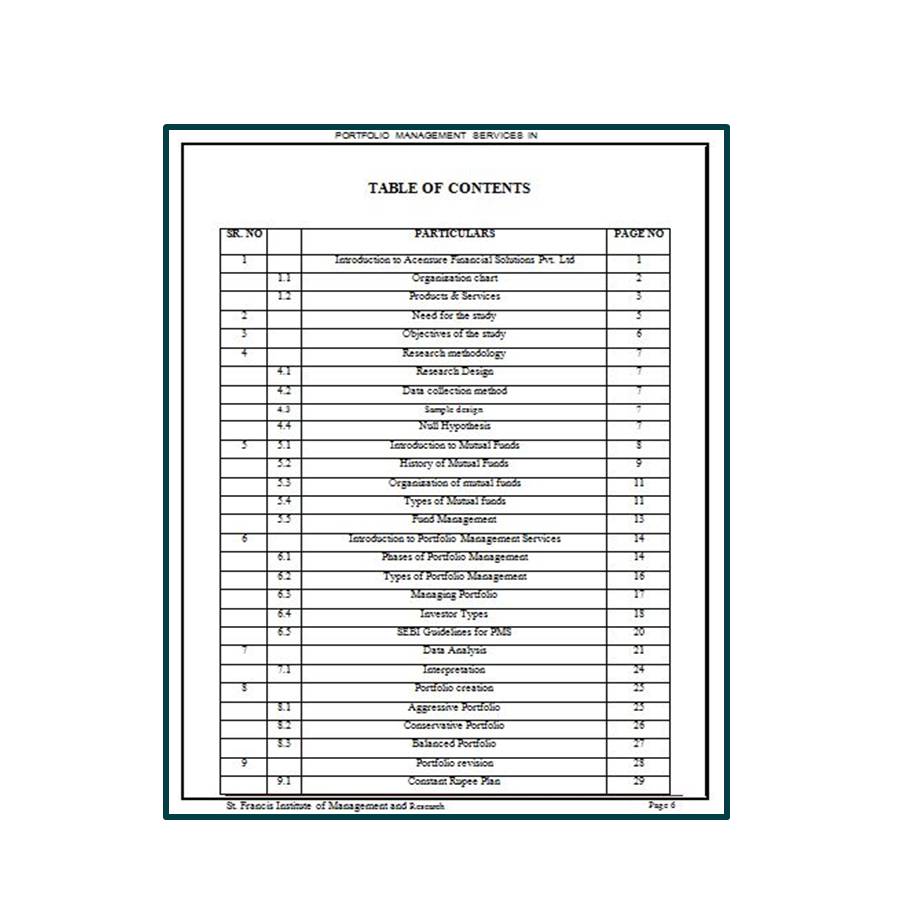

Content

| SR. NO | PARTICULARS | PAGE NO | |

| 1 | Introduction to Acensure Financial Solutions Pvt. Ltd | 1 | |

| 1.1 | Organization chart | 2 | |

| 1.2 | Products & Services | 3 | |

| 2 | Need for the study | 5 | |

| 3 | Objectives of the study | 6 | |

| 4 | Research methodology | 7 | |

| 4.1 | Research Design | 7 | |

| 4.2 | Data collection method | 7 | |

| 4.3 | Sample design | 7 | |

| 4.4 | Null Hypothesis | 7 | |

| 5 | 5.1 | Introduction to Mutual Funds | 8 |

| 5.2 | History of Mutual Funds | 9 | |

| 5.3 | Organization of mutual funds | 11 | |

| 5.4 | Types of Mutual funds | 11 | |

| 5.5 | Fund Management | 13 | |

| 6 | Introduction to Portfolio Management Services | 14 | |

| 6.1 | Phases of Portfolio Management | 14 | |

| 6.2 | Types of Portfolio Management | 16 | |

| 6.3 | Managing Portfolio | 17 | |

| 6.4 | Investor Types | 18 | |

| 6.5 | SEBI Guidelines for PMS | 20 | |

| 7 | Data Analysis | 21 | |

| 7.1 | Interpretation | 24 | |

| 8 | Portfolio creation | 25 | |

| 8.1 | Aggressive Portfolio | 25 | |

| 8.2 | Conservative Portfolio | 26 | |

| 8.3 | Balanced Portfolio | 27 | |

| 9 | Portfolio revision | 28 | |

| 9.1 | Constant Rupee Plan | 29 | |

| 9.2 | Constant Ratio Plan | 35 | |

| 9.3 | Variable Plan | 40 | |

| 9.4 | Calculation of returns | 46 | |

| 10 | Mutual fund comparison & Rankings | 47 | |

| 11 | Limitations & Future Scope | 56 | |

| 12 | Findings & Suggestions | 57 | |

| 13 | My Learning | 58 | |

| 14 | Conclusion | 59 | |

| 15 | References | 60 |

| Services Offered |

| I only accept those projects that I can do 100% before the deadline.

Why you choose me? |

Reviews

There are no reviews yet